How to Create Goods/ Services in Tally for implement GST in Invoice?

GST is purely based on supply of Goods or Services. But if you want to Create a GST Tax / Services Invoice in Tally then you must setup your Goods or Services in Inventory. Tally calculate tax or manage a invoice on based of inventory, without inventory you can't be make a taxable invoice.

For Create of Inventory followings steps to be done:

1. Go to Inventory Info - Stock Items - Create

2. Create Name of your Inventory

3. Create Alias of your Inventory

4. Select under which category your Inventory falls. (Like if I create Pen Inventory then it is covered under printing & Stationary category)

5. Select No of units (Like 1 Carton contains 10 Nos. of product then you can use alternate units option after pressing F12 in Stock item Creation screen)

6. Set GST Applicable is to yes.

7. Set GST/Alter GST Details to yes. A new window will be appear on your screen

Classification remains undefined, Description of your inventory with HSN Code, Calculation type, Taxabilility whether taxable or not, Tax rate as prescribed in GST.

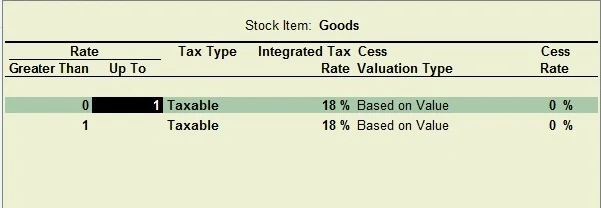

8. When you select Taxable a new window will appear on your screen to Setup the tax amount on which tax is applicable.

Select type of Inventory (Goods or Services), Rate of duty (Tax rate as mentioned in GST Act.). Press Enter to Save.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.