Tally is a complete Software to make all GST Compliance and making complete Invoices is very important part of GST Regime. Basically there is two type of Invoices can be made:

- With Inventory

- Without Inventory

With Inventory used to create invoice with Inventory / Stock and you can maintain your inventory completely with this feature. To activate Inventory in Tally follow these steps:

On Gateway of Tally - Press F11 - Accounting Features - Select Yes to Integrate Accounts with Inventory (See below image):

Inventory feature is very much useful for Manufacturing and Trading Industry. Through Inventory you can manage your inventory also you create BOM, UQC, Configure Alternate Units, Setup Price List, Maintain Multiple Godowns, Multiple Stock Categories and prepare your GST Returns with HSN Codes.

Creating a Stock Item

Creating a stock Item is very easy process. To create Inventory Go to Gateway of Tally - Inventory Info - Stock Item - Create (Press Shortcut key as I-I-C to create stock Item)

Inventory option will give you more than you want. You can handle multiple godown, maintain multiple Stock Categories, Maintain Batch wise details with product expiry date, you can also use different quantity option with inventory feature like actual and billed quantity. Invoice having actual quantity will reduce your Inventory and billed quantity will only show fake quantity in invoice and there is no impact on your inventory with billed quantity. Configuration for Invoice with inventory as follows:

Inventory option will give you more than you want. You can handle multiple godown, maintain multiple Stock Categories, Maintain Batch wise details with product expiry date, you can also use different quantity option with inventory feature like actual and billed quantity. Invoice having actual quantity will reduce your Inventory and billed quantity will only show fake quantity in invoice and there is no impact on your inventory with billed quantity. Configuration for Invoice with inventory as follows:

You can select yes to option which you want to use. If you want to create Debit / Credit Note in invoicing mode then Select Yes to Record Credit/ Debit Note in Invoice mode under Invoicing.

Now pass the sales voucher.

Now pass the sales voucher.

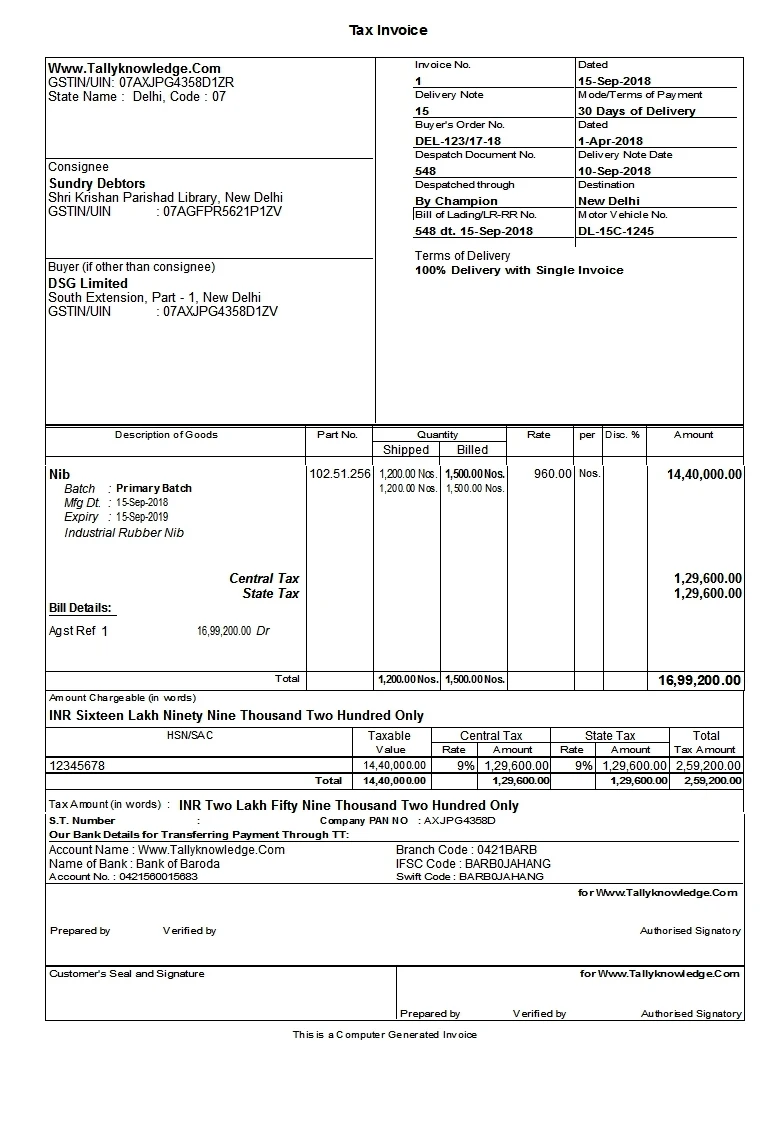

In above Invoice, you can see the details of Invoice No., buyer and consignor separate, dispatch details, details of batch with expiry date of product, Part No. of product, Quantity (Actual & Billed - GST will calculate on Billed quantity but inventory reduce actual quantity from your stock register), CGST and SGST calculated perfectly, HSN code and tax details appear. Bank details are coming, prepare and verified by authorize person details. In simple words this is a complete GST invoice.

Thanks for read the article. We will publish our Part - 2 on GST Invoice without Inventory. Stay connect.

Thanks for read the article. We will publish our Part - 2 on GST Invoice without Inventory. Stay connect.

If you have any query regarding GST Accounting then please email us @ haridasbetaramdas@gmail.com or smt_gogawat@yahoo.co.in or post your query on our official facebook fan page: www.facebook.com/tallyknowledge

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.