NCT of Delhi Govt. Introduce New Format of 2A & 2B of Sales Tax Return. Department of Trade & Taxes not accept hard copies. So File your return from August 2011 onward online with 2A & 2B

Select Month and Year which return you would like to file and get online submission of Form 2A & Form 2B. (Note: Right now the online return file manually as earlier).

If any problem you face, post a comment. I will be resolve your query as soon as possible.

Here some steps "HOW TO FILE 2A & 2B Online".

Open Web Browse and Go to : http://www.dvat.gov.in/dvatonline/index.php

& Click on New Online 2A and 2B Form

A New page appear like this:

Login with your Existing user id (Tin No) & Password:

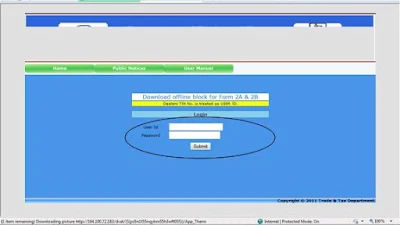

A New login window appear like this:

Click on Tab Form 2A, A new window appear like this:

Choose Month & Year From Drop Down Menu:

Enter Seller's Tin No. (Must be printed on Sellers Invoice) (In few case press tab to appear name automatically)

Enter Name (If seller registered online to sales tax department, name would be appear automatically)

Select Nature of Purchase

Purchase not eligible for Credit of input tax (Following options shows after click this link)

IF You select interstate purchase, you must be select form nature agst the purchase.

In same case

Purchase not eligible for Credit of input tax (Local Purchase)

There is two type of nature : Capital Goods & Others (Put Bill amount in this Box)

Select Others for Local Raw Material and Item Purchases. Follow these steps:

Name of Tax: Goods Taxable at

Rate of Tax: Vat Rate Charge on Bill

Input Tax Paid: Automatically Calculated on purchase Amount

Total Purchase Amount: This is total of your Bill amount (Including Tax)(Calculate Automatically)

Select Add on Right Side.

Same this method enter more entries and after fill full details click on save (Click on Save After every nature of Tax)

Form 2B

In same as Form 2A: Enter Tin & Name of Buyer

Select appropriate nature of Sales (Taxable or InterState, Branch Transfer, Export, HighSeas or Exempted)

Select Tax Rate (If applicable to nature of Sales)

Click on Add

Enter more entries in same method and then click on Save.

The process of input the Annexure (Form 2A & 2B) is complete according to Sales Tax Department.

Click on Tab (Approval Forms)

Select Month and Year which return you would like to file and get online submission of Form 2A & Form 2B. (Note: Right now the online return file manually as earlier).

If any problem you face, post a comment. I will be resolve your query as soon as possible.

The minor towers next to the citizen

2 Comments

Oh i seen This! Really tally will release update every time so this format will change soon because tally software are always dynamic!

ReplyDeleteUptra Services

other article

ReplyDeleteother article

other article

other article

other article

other article

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.