Journal Entry

Journal Vouchers are used to adjust the debit and credit

amounts without involving the cash or bank accounts. Hence, they are referred

to as adjustment entries.

Creating a Journal Entry

Journal entries

are usually used for finalization of accounts.

To

pass a Journal Voucher,

Go

to Gateway of Tally - Accounting Vouchers

·

Click

on F7: Journal on the Button Bar or press F7.

For

example, there may be entries made for interest accrued or interest due. If you

have to receive Interest from a party, the same can be entered using Journal

Voucher.

1.

Debit the Party

2.

Credit the Interest

Receivable Account

The

Journal entry is displayed as shown:

Special Keys for Voucher Narration Field:

· ALT+R:

Recalls the Last narration saved for the first ledger in the voucher,

irrespective of the voucher type.

·

CTRL+R:

Recalls the Last narration saved for a specific voucher type, irrespective of

the ledger.

Allowing Cash Accounts in

Journals

Journals

are adjustment entries, which do not involve Cash account and Bank account.

However in exceptional cases where the user would like to account Journal

entries involving Cash/Bank Account, Tally.ERP 9 has the flexibility of passing

such entries by enabling the option under F12 configuration.

To enable Cash

Accounts in Journal voucher,

·

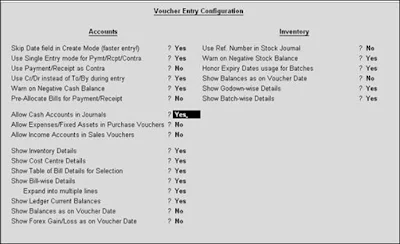

Set Allow Cash

Accounts in Journals to Yes in F12:

Configure (Voucher Entry Configuration).

To

pass a Journal voucher with Cash/Bank Ledger,

1.

Go to Gateway of Tally - Accounting Vouchers - Select F7: Journal

2.

Press the spacebar

at the Debit or Credit field.

The

Journal Voucher Screen with Cash/Bank Ledger selection

will appear as shown:

Debit Note Entry

Debit Note is a document issued to a party stating that you

are debiting their Account in your Books of Accounts for the stated reason or

vise versa. It is commonly used in case of Purchase Returns,

Escalation/De-escalation in price, any other expenses incurred by you on behalf

of the party etc.

Debit

Note can be entered in voucher or Invoice mode.

You

need to enable the feature in F11: Accounting or

Inventory features.

·

To use it in Voucher

mode you need to enable the feature in F11 :Accounting

Features - Use Debit / Credit Notes.

·

To make the entry in Invoice mode enable the option F11:

Accounting Features - Use invoice mode for Debit Notes.

To

go to Debit Note Entry Screen,

Go

to Gateway of Tally - Accounting Vouchers

·

Click on Ctrl+F9:

Debit Note on the Button Bar or press Ctrl+F9.

You

can toggle between voucher and Invoice mode by clicking Ctrl+V.

Pass

an entry for the goods purchased returned to Supplier A:

Special Keys for Voucher

Narration Field:

·

ALT+R:

Recalls the Last narration saved for the first ledger in the voucher,

irrespective of the voucher type.

·

CTRL+R:

Recalls the Last narration saved for a specific voucher type, irrespective of

the ledger.

Credit Note Entry

Credit Note is a document issued to a party stating that you

are crediting their Account in your Books of Accounts for the stated reason or

vise versa. It is commonly used in case of Sales Returns,

Escalation/De-escalation in price etc.

A

Credit Note can be entered in voucher or Invoice mode.

You

need to enable the feature in F11: Accounting or

Inventory features.

·

To use it in Voucher

mode you need to enable the feature in F11 :Accounting

Features - Use Debit / Credit Notes.

·

To make the entry in Invoice mode enable the option F11:

Accounting Features - Use invoice mode for Debit Notes.

To go to Credit Note Entry Screen:

Go to Gateway of Tally - Accounting Vouchers

1. Click on Ctrl+F8: Credit Note on the Button Bar

or press Ctrl+F8.

You can toggle

between voucher and Invoice mode by clicking Ctrl+V.

Pass an entry for

goods sold returned from Customer A:

Special Keys for Voucher

Narration Field:

·

ALT+R:

Recalls the Last narration saved for the first ledger in the voucher,

irrespective of the voucher type.

·

CTRL+R:

Recalls the Last narration saved for a specific voucher type, irrespective of

the ledger.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.