The

CBDT has noted that many taxpayers are committing mistakes while furnishing

their tax credit claims in the return of income.

Such

mistakes include:

§ quoting

of invalid/incorrect TAN;

§ quoting

of only one TAN against more than one TAN tax credit;

§ furnishing

information in wrong TDS Schedules in the Return Form; furnishing wrong challan

particulars in respect of Advance tax, Self-assessment tax payments etc.

As

a result of these mistakes, the tax credit cannot be allowed to the taxpayers

while processing returns despite the tax credit being there in 26AS statement.

The CBDT, therefore, desires the taxpayers to verify if the demand in their

case is due to tax credit mismatch on account of such incorrect particulars and

submit rectification requests with correct particulars of TDS/tax claims for

correction of these demands.

The

procedure for filing online rectification request has been given below:

Rectification

Request

Rectification

request can be filed u/s 154 of the Income Tax Act by the taxpayer in case of

any mistake apparent from the record.

Prerequisite

to file Rectification request

1.

The Income Tax Return for the Assessment Year should have been processed in

CPC, Bangalore.

2.

An Intimation under Section 143(1) OR an order under Section 154 passed by CPC,

Bangalore for the e-Filed Income Tax return should be available with the

taxpayer.

3.

For Electronic returns filed and processed at CPC, only online rectifications

will be considered.

4.

If the refund arising out of return processed at CPC is adjusted against the

demand of other Assessment Years and then the assessee is challenging the

demand itself, in that case

§ Rectification

application has to be filed for the demand year, if the demand was raised by

CPC then online application has to be filed

§ For

the demand raised by the Field Assessing Officer, the application has to be

filed before him.

5.

No rectification has to be filed for giving credit to taxes paid after raising

the demand. To file your Rectification, you should be a registered user in

e-Filing application.

Step By

Step guide on how to file rectification at Income Tax e-filing Site:

To

file your Rectification, you should be a registered user in e-Filing

application.

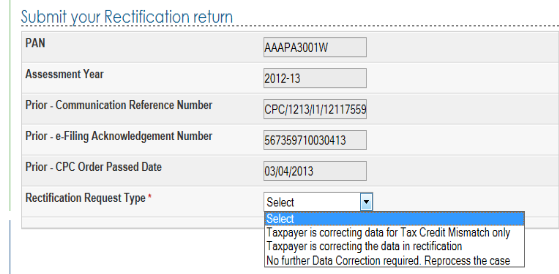

Step

1 – LOGIN to e-Filing application and GO TO – My Account – Rectification

request.

Step

2 – Select the Assessment Year for which Rectification is to be e-Filed, enter

Latest Communication Reference Number (as mentioned in the CPC Order).

Step

3 – Click ‘Submit’.

Step

4 – Select the ‘Rectification Request type’.

Step

5 − On selecting the option ‘Taxpayer Correcting Data for Tax Credit mismatch

only’, three check boxes, TCS, TDS, IT, are displayed. You may select the

check-box for which data needs to be corrected. User can add a maximum of 10

entries for each of the selections. No upload of any ITR is required.

Step

6- On selecting the option ‘Taxpayer is correcting the Data in Rectification’ −

select the reason for seeking rectification, Schedules being changed, Donation

and Capital gain details (if applicable), upload XML and Digital

Signature Certificate (DSC), if available and applicable. You can select a

maximum of 4 reasons.

Step

7 – On selecting the option, ‘No further Data Correction required. Reprocess

the case’ − check-boxes to select- Tax Credit mismatch, Gender mismatch (Only

for Individuals), Tax/ Interest mismatch are displayed. User can select the

check-box for which re-processing is required. No upload of an ITR is required.

Step

8 – Click the ‘Submit’ button.

Step

9 – On successful submission, following message is displayed.

Step

10 – You can check status of rectification request online through your account

login. Further you can withdraw rectification request, if you have filed it

incorrectly or if it is no more required.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.