Section 80CCD allows an employee, being an individual

employed by the Central Government or any other employer, on or after the

1-1-2004, a deduction of an amount paid or deposited out of his income chargeable to tax

under a pension scheme as notified or as may be notified by

the Central Government, vide Notification F. N. 5/7/2003-

ECB&PR, dated 22-12-2003.

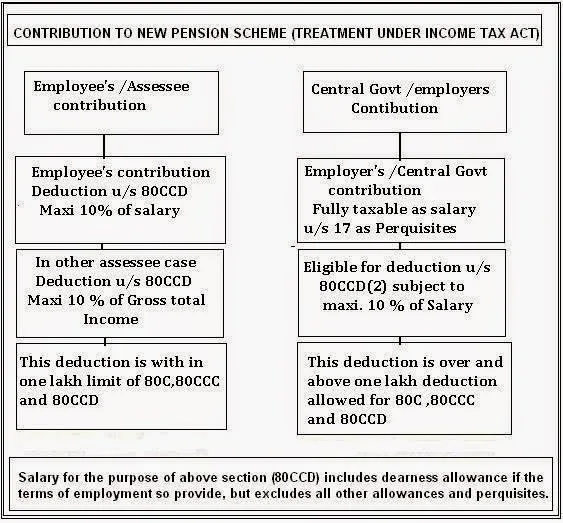

However, the deduction shall not exceed an amount equal to 10% of his salary (includes Dearness Allowance but excludes all other allowance and perquisites).

Further where in the case of an employee receives any contribution in

the said pension scheme from the Central Government or any other employer

then the employee shall be allowed a deduction from his total income

of the whole amount contributed by the Central Government or any other

employer subject to limit of 10% of his salary of the previous year.

Taxation at the Time of out of pension scheme and treatment of Annuity: if any amount is standing to the credit of the

employee in the pension scheme referred above and deduction has been

allowed as stated above and the employee or his nominee receives this amount

together with the amount accrued thereon, due to the reason of

(i) Closure or opting out of the pension scheme or

(ii) Pension received from the annuity plan purchased and

taken on such closure or opting out

then the amount so received during the FYs shall be the

income of the employee or his nominee for that Financial Year and

accordingly will be charged to tax.

Where any amount paid or deposited by the employee has been

taken into account for the purposes of this section, a deduction with

reference to such amount shall not be allowed under section 80C.

Further it has been specified that w.e.f 1-4-2009 any amount

received by the employee from the new pension scheme shall be deemed not

to have received in the previous year if such amount is used for purchasing

an annuity plan in the previous year.

Employee Contribution :It

is emphasized that as per the section 80CCE the aggregate amount of deduction

under sections 80C, 80CCC and Section 80CCD(1) shall not exceed Rs.

1,00,000/-

Employer's contribution : However the contribution made by the Central Government or any other employee to a pension scheme u/s 80CCD(2) shall be excluded from the limit of Rs.1,00,000/- provided under this Section.

Contribution by Govt /Employer to New Pension scheme /Contributed

Pension scheme is taxable in the hand of Employee as perquisites :. Any contribution made by the Central Government or

any other employer to the account of the employee under the New Pension

Scheme as notified vide Notification F.N. 5/7/2003- ECB&PR, dated 22-

12-2003 referred to in section 80CCD above shall also be included in

the salary income.

Example :

Salary

=20000 DA=10000 Other taxable allowance =10000

Total Monthly

=40000 Yearly 480000

Employer's

contribution to NPS (CPF)=10% of 30000=3000= Yearly=Rs 36000/-

Employee contribution to NPS (CPF) =10% of 30000=3000=Yearly =

Rs 36000/-

Employee invested

30000 in Insurance Policy eligible u/s 80C

PPF =44000

Computation of

Income

Income from

Salary

= 480000/-

Add : employer's

contribution to CPF/NPS =

36000/-

Gross Total

taxable salary (income) (A) = 516000/-

Less : Deduction

u/s 80C LIC

:

30000

PPF=

: 44000

employee's share

CPF :

36000 (80CCD)

Total

=

:110000/-

(but maxi one

lakh)

=100000/-

Less :Employer's

contribution to CPF

deduction u/s

80CCD(2)

=36000/-

Total deduction

(B)

=136000/-

Net Taxable

Income (A) -(B)=516000-136000 =380000/-:

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.