Tally.ERP9 is the most usable accounting Software in India. It is used in Industries, Firms, Educational Institutes, CA Firms etc. and all these needs to fulfil their statutory compliances in Tally.ERP9 (VAT, Income Tax, TDS, Service Tax, Excise, Payroll Etc.).

Some units are not properly configure their Statutory compliances in Tally.ERP9 software and they failed to prepare their financial statements through the software and do all the work manually. So now, we provide you this turorial to how to configure all the statutory compliances in Tally.ERP9 effectively.

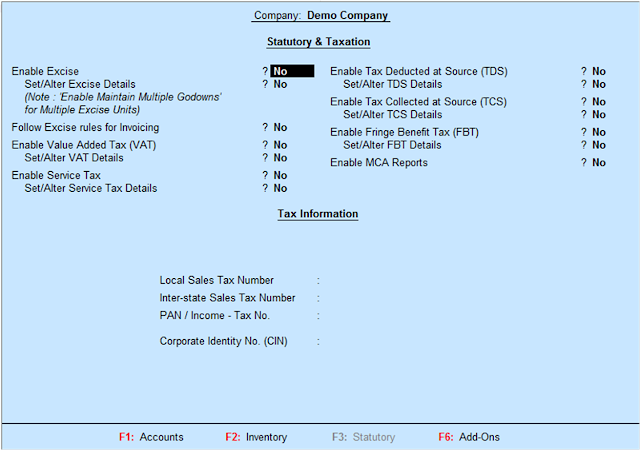

In Tally.ERP9, there is two options to fulfil statutory compliance details. 1st is from Company's main page, Press F11 for Company Features (Image 1):

|

| Image1 |

|

| Image2 |

You can enter all the Statutory details of your company at here.

Now 2nd option is use from Direct Voucher Entry. In Voucher entry Press F11, Accounting Features appear on your voucher screen, now press F3, you can see the above Image2 in your Voucher Entry. Fill up all the details and accept "Yes".

Now your company is fully configure for all types of Government Statutory Compliances.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.