How to Update Stock Item and Stock Group for GST Compliance?

Stock Configuration is a major part to integrate GST in Tally. Without Stock Item or Group setup you can't get benefit of GST Compliances in Tally.

So If you sold an item with different tax rates, update your stock item master or stock groups with the applicable GST Rates and the type of supply as applicable.

For Updating a Stock Item

In case you need different Tax Rates for different items, modify the stock item to include the applicable tax rates as applicable under GST Act.

For updating a stock item go to Gateway of Tally - Inventory Info - Stock Items - Alter

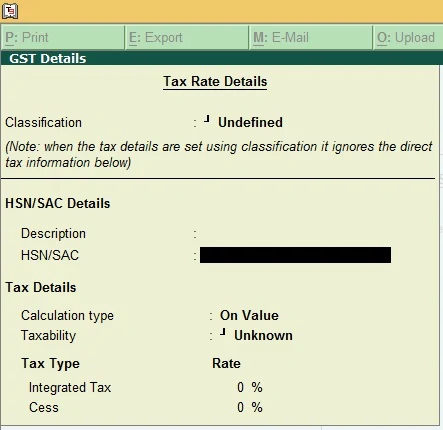

Go to Set/Alter GST Details and select it to Yes. When you select yes following option appear on your screen

Enter details required in above screen. Select Taxability is to Taxable, Integrated Tax as per your norms (Suppose if your tax rate is 18% then it will be divided 9% each between Central and State Tax). Enter Cess if applicable. Press Enter to Save.

Now Select the Type of Supply whether it is Goods or Services.

Press Enter or Ctrl + A to Save.

Updating a Stock Group

To update Stock Group Go to Gateway of Tally - Inventory Info - Stock Group - Alter

Select Set / Alter GST Details to Yes and following window will be appear on your screen:

Fill the details as specified in Stock Item Details

After enter the details Press Enter or Ctrl + A to Save.

Your stock Item & Stock Group is fully configured for GST compliances.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.