This is the biggest question of Tally users that how to treat Cash Expenses under reverse Charge in Tally? This question is also raised by our facebook fans, whatsapp group members and our online viewers. We also contact to Tally about this issue and the problem is resolved by Tally by return mail.

As per Tally representative, to Create Expenses (Under Reverse Charge) you have to create Expenses through purchase voucher. But before this you have to configure your expenses ledger for reverse charge mechanism.

To enable reverse charge on expenses - Gateway of Tally - Accounts Info - Ledger - Alter:

Alter your expenses ledger, Select applicable on GST and set alter to Yes. Now Press F12 for configuration and select yes to Reverse Charge applicable (as below image).

Press Enter or Ctrl + A to save the voucher.

As mentioned above all the expenses under reverse charge, entry will be make in Purchase Voucher and payment made by Cash Account. If expenses account not appear in purchase voucher then press F12 and select yes to Allow Expenses/ Fixed Assets for accounting allocations:

This option allow you to Enter expenses ledger in purchase voucher. Now create a purchase entry with expenses under Reverse Charge.

Before save the entry Press Alt + A for tax analysis, you can see there is automatic calculation of CGST and SGST will be made by system but not showing as ledger level. Press Enter to save the voucher entry.

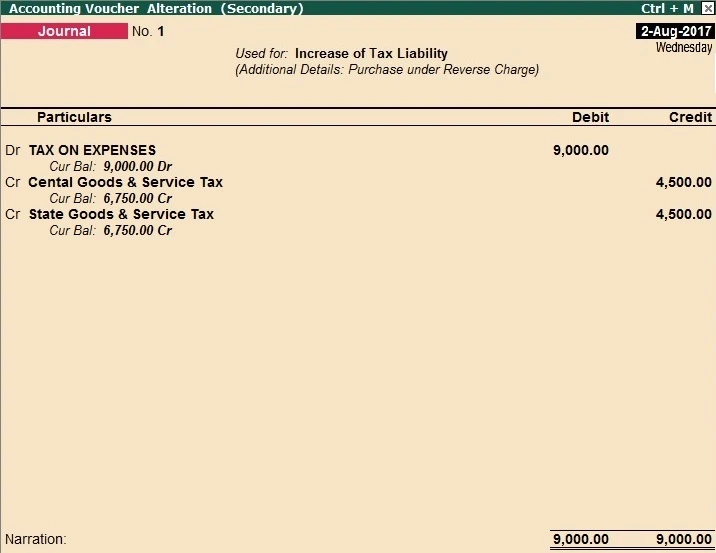

Now create a journal voucher and press Alt + J for Statutory Adjustment of Taxes. Create another ledger named "Tax on Expenses" under current assets.

Press Enter to Save the Voucher. This journal voucher create your actual tax liability generated for Reverse Charge.

Now make a payment voucher to pay this liability. Go to Gateway of Tally - Accounting Voucher - Payment (F5). Press Alt + S or click on stat payment on right side status bar for make the statutory payment. Select GST, specified period for which you have to make the payment, Select recipient liability (recipient liability will set off the liability of reverse charge).

Press Enter or Ctrl + A to Save the Voucher.

Similarly you can create a cash voucher to create reverse charge tax liability on expenses. But Expenses routed through cash is lengthy process. Payment made by cash in reverse charge is not calculated at Voucher Entry Level. You have to check the tax liability in GSTR - 2 in B2B Invoice. See below video for more information

Remember if you pay under Reverse Charge you must have enable option for Nature of Transaction and also Enable Reverse Charge applicability on Expenses.

Press Enter to Save the Voucher. This journal voucher create your actual tax liability generated for Reverse Charge.

Now make a payment voucher to pay this liability. Go to Gateway of Tally - Accounting Voucher - Payment (F5). Press Alt + S or click on stat payment on right side status bar for make the statutory payment. Select GST, specified period for which you have to make the payment, Select recipient liability (recipient liability will set off the liability of reverse charge).

Press Enter or Ctrl + A to Save the Voucher.

Similarly you can create a cash voucher to create reverse charge tax liability on expenses. But Expenses routed through cash is lengthy process. Payment made by cash in reverse charge is not calculated at Voucher Entry Level. You have to check the tax liability in GSTR - 2 in B2B Invoice. See below video for more information

Remember if you pay under Reverse Charge you must have enable option for Nature of Transaction and also Enable Reverse Charge applicability on Expenses.

5 Comments

BUT HOW TO BOOK AN UNREGISTERED INVOICE, THROUGH A SINGLE EXPENSE LEDGER, WHICH HAS MORE THAN ONE HSN/SAC CODES AND HENCE DIFFERENT GST RATES ?

ReplyDeleteDO YOU WANT TO BOOK PURCHASE RECORD FROM UNREGISTERED DEALER?

DeleteYOU CAN JOIN OUR WHATSAPP GROUP THROUGH CLICK ON LINK IN RIGHT SIDE BAR SHOWING JOIN OUR WHATSAPP GROUP OR CLICK ON BELOW LINK

https://chat.whatsapp.com/94YlJCJNE78Lnm65DN5CN0

NO SIR, I WANT TO BOOK EXPENSE (INWARD SUPPLY) FROM UNREGISTERED DEALER

Deletesuppose we have recd exp. bill included gst so how can i entry pass on our tally also how can we get gst amount in refund

ReplyDeleteEnter a purchase voucher and press alt + I for only accounting voucher (this function only available when you having invoicing mode)

ReplyDeleteNo spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.