In previous posts we know about generate GST liability through Sales Invoice or Liability under Reverse Charge Mechanism.

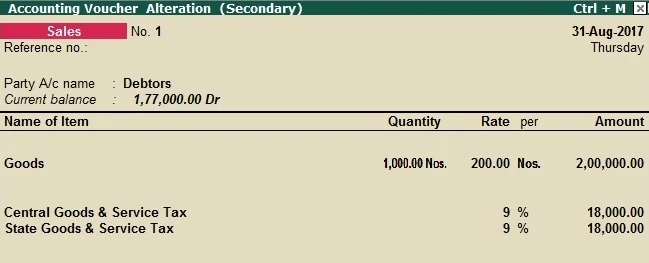

For Example: Sumit Sold Goods of Rs. 200000/- to Debtors (Registered dealer) with total GST @ 18% (9% Central Goods & Service Tax & 9% State Goods & Service Tax).

Dr. Debtors 236000/-

Cr. Sales 200000/-

Cr. Central GST @ 9% 18000/-

Cr. State GST @ 9% 18000/-

Through this entry we can book our output liability of GST. For payment of your Output GST. Go to payment voucher and press Alt + S for Statutory Payment. You can see the following details required for GST Statutory Payment.

You can see there is three option for payment type. Advance is for Advance payment received under Reverse Charge. Recipient liability for goods/ service from unregistered dealer and last one is for Regular output GST.

Select Regular output GST and enter details of your output liability.

Select yes to provide gst details and enter the details required by system like mode of payment (select payment mode whether cash, cheque, credit card, debit card, demand draft, net banking etc.), enter name of the bank from which payment has been made, CPIN Number Generated by GST portal at the time of payment, Challan number, and payment date.

Now your entry is complete.

Other than this you can made payment of Interest, Late Payment, Penalty or any other fees through this method but ensure that all these ledger will be grouped under Expenses Indirect.

When you pass GST payment voucher of any liability mentioned in above paragraph then system ask you to specify the nature of payment for the same.

Create payment entry, press Alt + S for GST Statutory payment. Select bank and ledger (Interest, Late fee, Penalty or any other fees). See below image:

You can pass same entry for Penalty, Late fees or other charges levied under GST.

For more information see below video:

For more information see below video:

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.