You can claim the excess amount paid as tax, interest, penalty fee, or other dues as refund using a journal voucher.

To record a journal voucher for refund.

1. Go to Gateway of Tally - Accounting Vouchers - Journal

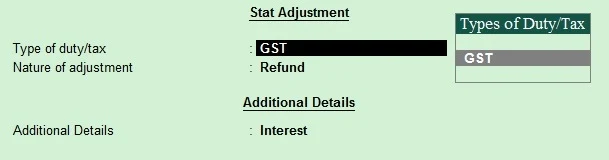

2. Click J: Stat Adjustment or press Alt + J

3. In the Stat Adjustment Details Screen, select the options as shown below:

4. Press Enter to save and return to the journal voucher.

5. Debit the bank ledger, and enter the amount of interest liability.

6. Credit the GST Ledger or ledger grouped under Current Assets.

7. Press Ctrl + A to accept the journal voucher.

Similarly, you can record the journal voucher by selecting the Additional Details in the Stat Adjustment Details as:

- Not Applicable, for refund of excess tax payment made.

- Penalty, for refund of excess payment towards penalty.

- Late Fee, for refund of excess payment made towards late fee.

- Others, refund of excess payment made towards other dues.

2 Comments

Nicely describe but how to download in mobile. There are no option for save this. Plz provide in PDF format

ReplyDeleteHowever, there are cases where its computation is erroneous and necessitates an adjustment. Whenever that happens,a tax refund is paid back to the tax filer in that year. QuickRebates

ReplyDeleteNo spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.