Any person who work for any entity get money at the end of the month or at the end of contract got salary / wages. Employee gets salary and labour gets wages. Adjustment of Salary through Journal is not much difficult. For Example:

Monthly salary of Employees of Company A is as follows:

Salary of Mr. Sumit Gogawat is Rs. 42000/-

Salary of Mr. Rajesh is Rs. 35000/-

Salary of Mr. Ankush is Rs. 30000/-

Salary of Mr. Hitarth is Rs. 20900/-

Salary of Mr. Vijay is Rs. 18000/-

Salary of Mr. Sachin is Rs. 15000/-

If we need to enter Salary individually then we have to create each ledger under Indirect Expenses - Group Salary / Wages. Ledger of Salary under indirect Expenses looks like below:

All ledgers of Salary under indirect expenses create in the same manner. Now we create Ledger "Salary Payable" under Current Liabilities, which will be use to made payment to each employee after deduction of advance, tds or any other liability.

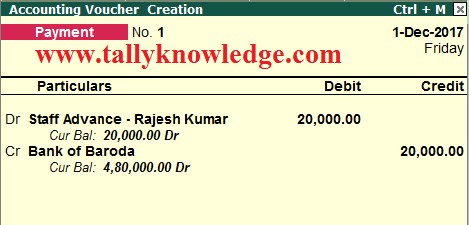

For Example: Rajesh get Advance of Rs. 20000 from company on 1st December 2017 and we need to enter payment voucher of Rs. 20000 as staff advance in the name of Mr. Rajesh. Note: Staff Advance ledger will be create under Current Assets/ Loans and Advances.

Mr. Rajesh is agree to deduct Rs. 5000 per month for next 4 months from his salary. Then his net salary will be 30000 but we debit his salary @ Rs. 35000 and net payable to him is Rs. 30000.

Normal Salary Entry

As above example, Normal salary entry will be look like this:

Above entry is a simple example without any deduction or advance to employee or any statutory dues. Expenses of Salary debited to Profit & Loss account and amount payable to employees go to Current Liabilities as outstanding.

Now we create Entry of Staff Advance. Below is the example of Staff advance entry.

Above screenshot showing that advance to Mr. Rajesh Kumar deduct Rs. 5000 from his november month salary and net payable is reduced to Rs. 5000. If you want to show Net Payable effect in each employee salary then you need to create each employee deduction ledger under current liabilities.

18 Comments

Great and Valuable post. Thanks for sharing it. Kanhasoft is the experienced firm for ERP software development. We can develop your application according to your business needs from scratch. Visit our website to know more.

ReplyDeleteCan you give me all concept of tally with examples in my Gmail id.

ReplyDeleteSir can we pass salary through payment voucher ?

ReplyDeleteYes you can pass direct payment voucher of salary to staff

DeleteYes

ReplyDeleteDear Sir,

ReplyDeleteaccrued salalry: journal enty (..............................)

Payment Salary : payment entry(..............................)

Advance salary paid entry??????.......................

Please write your query in detail

DeleteSir,how to pass ledger that we can see in p/L account salary in one column of all the staff.

ReplyDeleteYou need to make group of Employee Salary under expenses indirect and group all salary ledger under this. Then pass a normal journal entry to debit individual salary to each employee

DeleteDear sir,

ReplyDeletePlease tell me, if we salary paid through cash then how to maintain record & entry in tally.

Above illustration for cash payment also. While make payment you need to Dr. Salary Payable Cr. Cash

DeleteSalary payable is indirect expenses or direct expense

ReplyDeleteIndirect expenses

DeleteSALARY PAYBLE IS PROVISON(CURRENT LIABILTY)

ReplyDeletesalary back charge entry to different department/same entity??

ReplyDeletehoe to pass entry with pt

ReplyDeletei want to book salary payables for Mar 22 as financial year is ending. what is the journal entry

ReplyDeletesir individual employee ledger kis group me aayega

ReplyDeleteNo spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.