How to use a single Ledger for all GST Tax calculation in TallyERP.9?

In this post, we teach you to how to use a single ledger for use multiple taxation for Output Liability and Input Tax Credit or even if applicability of Reverse Charge to specific expenses/ purchases.

Generally, Lots of users create separate ledger for each tax category. For Example if you Purchase printing and stationary items containing different taxes in the invoice like Expenses of Rs. 1500 is of 18% then tax thereon is Rs. 270 Total - 1770 and same bill having expenses of Rs. 1500 of 28% then tax thereon is Rs. 420 Total - 1920.

In above case, you have to create separate ledgers for book expenses for input credit of each tax category. Different ledgers help you to allocate tax rate wise ledgers in Profit & Loss but it looks very awkward when you open or represent your account statements. If there is 5 types of taxation on a single ledger then you need to create 5 separate ledgers for each tax category but method mention in this post will help you to use single ledger with multiple taxes and tax will be calculate in voucher as per your requirement.

So how to do this, as per above example we create ledger of Printing and Stationery.

For create ledger go to Gateway of Tally - Ledgers - Create:

In above pic you can see we select no in Set/ Alter GST Details, when you create the ledger remain it No. This will not effect in your GST Returns till you pass the entry of booking of expenses or services.

Now pass a Purchase or payment voucher to book expenses and showing Input Tax Credit. Purchase voucher will calculate input tax credit automatically and in payment voucher you need to enter input credit manually for each tax rate.

So as per suggest pass a purchase voucher.

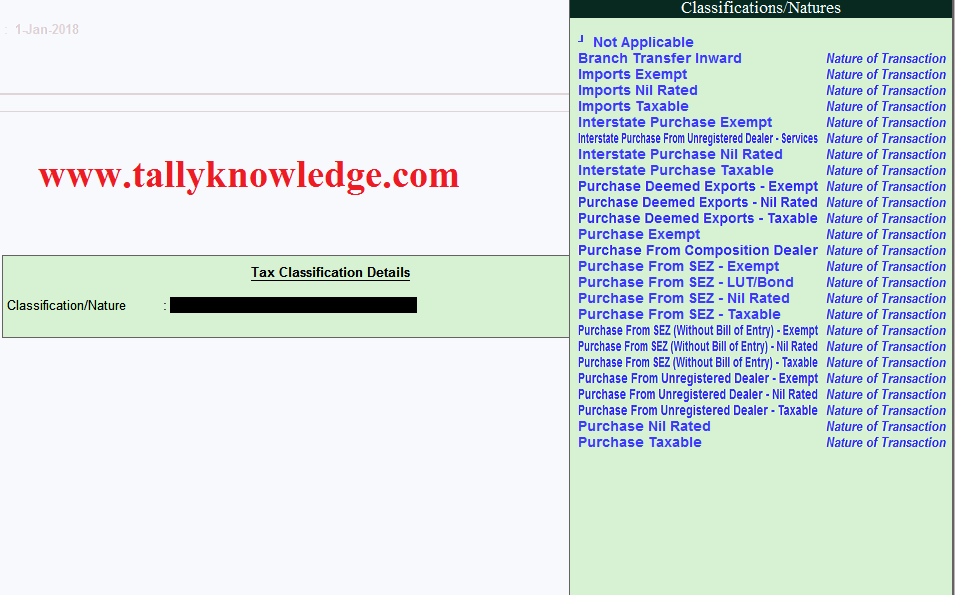

Select ledger and enter taxable amount, when you press Enter Tax classification appear on your screen like below image:

Press F12 on Tax Classification details, configuration of Tax Classification appear on your screen like below image:

Select all options as yes. This will enable GST Taxation details in voucher entry and this will show in each entry whether it is sales, purchase, journal, payment or any other adjustment entry.

In above image, we select classification as Purchase Taxable (For Input Credit), Enter rate of Tax @ 9% each for CGST and SGST, now system will calculate tax on expenses/ purchase @ 18% automatically. Similarly if you want to enter tax rate expenses or purchase @ 28% then enter another ledger just after 18% expenses and again follow the same method as select in 18% tax classification. See below image for details:

Press Alt + A or Click on Tax Analysis on right side bar and you can see tax is calculated on different rates.

Its Done! Details of tax rate wise expenses / purchase will appear in your GSTR 2/ GSTR 3B.

Watch video for more info:

5 Comments

i am unable to get tax (GST) classification as shown in your guide kindly advice

ReplyDeleteWatch video for more information. Press F12 at the time of selection of tax classification and select all option as yes

DeleteAwesome review, I am a major devotee to remarking on web journals to educate the web journal scholars realize that they've added something beneficial to the internet!.. gpwlaw-mi.com/new-york-mesothelioma-lawyer/

ReplyDeletenice

ReplyDeletePlease let me know if you’re looking for a article writer for your site. You have some really great posts and I feel I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some material for your blog in exchange for a link back to mine. Please send me an email if interested. Thank you! caaf cgil genova

ReplyDeleteNo spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.