In India gratuity is a type of retirement benefit. It is a payment made with the intention of helping an employee monetarily after his retirement. The payment of Gratuity Act was passed by Indian Parliament in 21st August 1972.

In this post we know about setup of Gratuity pay head in Tally.

Its a very small and very easy process. To create the Pay Head for Gratuity Computation.

Go to Gateway of Tally - Payroll Info - Pay Head - Create:

Enter the Name of Pay Head.

Enter the Slab Rate details for Gratuity Calculation in the Sub-Screen as shown:

Select Provisions as Group from the List of Groups in the field under.

Set Alter Income Details to Yes.

In the Income Tax Details Screen:

- Income Tax Components is defaulted to Gratuity while creating the Gratuity pay head.

- Tax Calculation basis is defaulted to On Actual Value as Grauity is paid only while leaving the organization or retiring

Deduct TDS across period is defaulted to No as the tax has to be deducted in the same month when gratuity is paid.

Select the rounding method as applicable.

Accept to save the Pay Head.

Note: To use the Earning Pay Head for Gratuity calculation, set Use for Gratuity? field to Yes in the ledger creation screen (for Pay Heads such as Basic Salary, DA, and so on, created under Indirect Expenses).

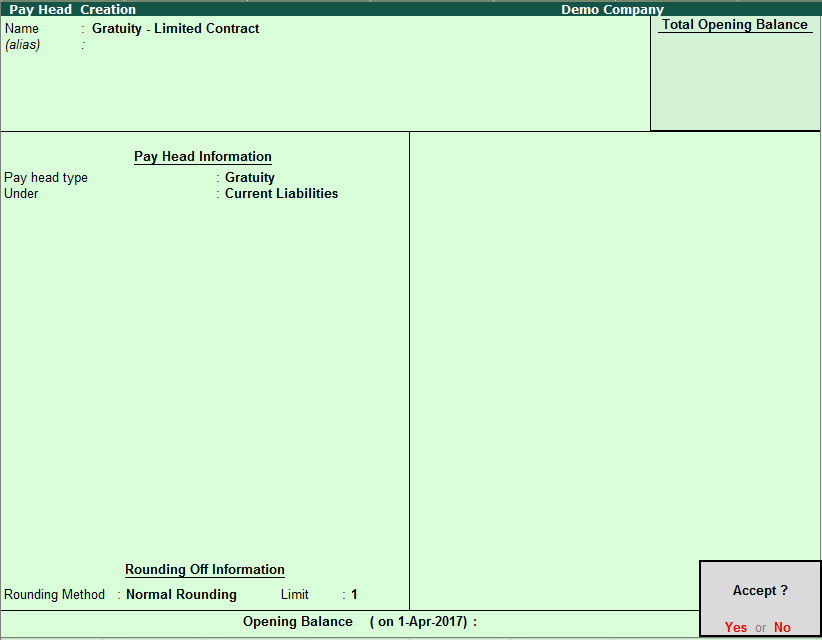

Gratuity for Contract - Limited Period

To create a gratuity pay head for an unlimited contract,

Go to Gateway of Tally - Payroll Info. - Pay Head - Create

Enter the Name of the Pay Head

Select Gratuity from the List of Pay Head Types

Enter the Slab Rate details for Gratuity Calculation in the sub-screen as shown:

Select the Rounding Method from the list, if applicable.

Accept to save the pay head.

Note: Ensure that the Employer Unique ID is entered in the F11: Statutory & Taxation features screen

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.